Create multi year (discounted) cash flow

This page shows how to create a “commercial” multi year cash flow. There are small variations based on property type, but these are the basic steps.

Set up multi year cash flow assumptions

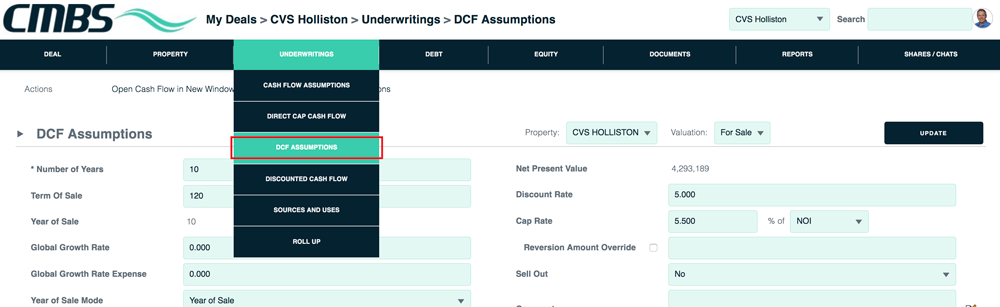

Go to Underwritings > DCF Assumptions.

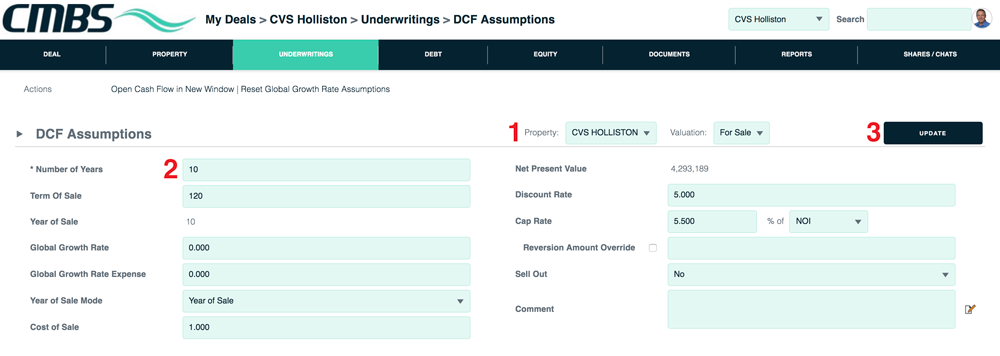

1. Verify that the correct property and underwriting are selected in the menus.

2. Enter the number of years, which is required. Add more info if you like. You can always come back.

3. Click the Update button to save your assumptions.

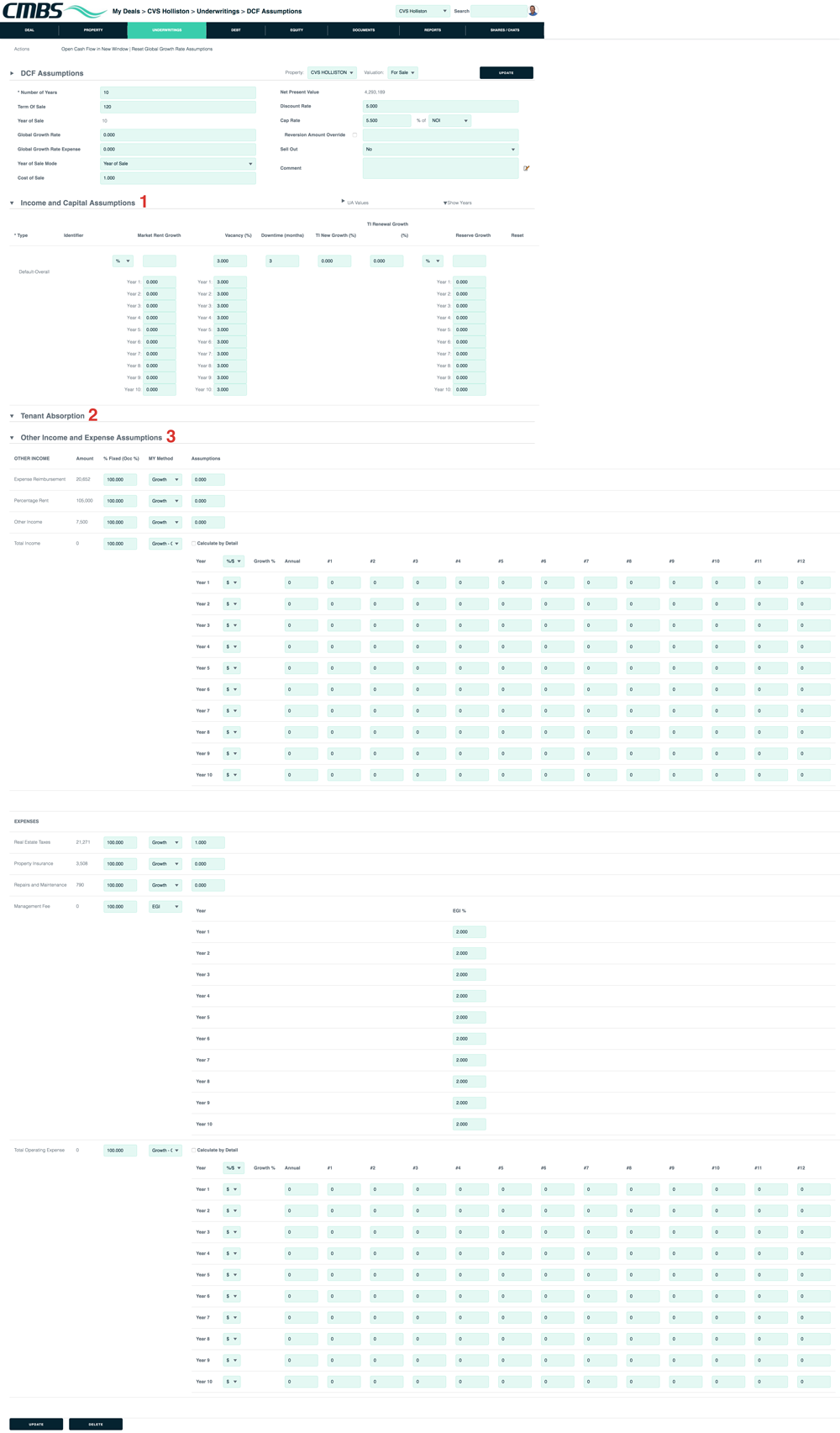

After you save your stabilized cash flow assumption, more settings become populated and available.

1. Income and Capital Assumptions: Grow/adjust lease level assumptions from the stabilized cash flow.

2. Tenant Absorption: Vacant space will be leased based on the Term.

3. Other Income and Expense Assumptions: Can be percent of EGI, straight growth or custom growth.

Review and/or edit the settings, then click the Update button. You can always come back.

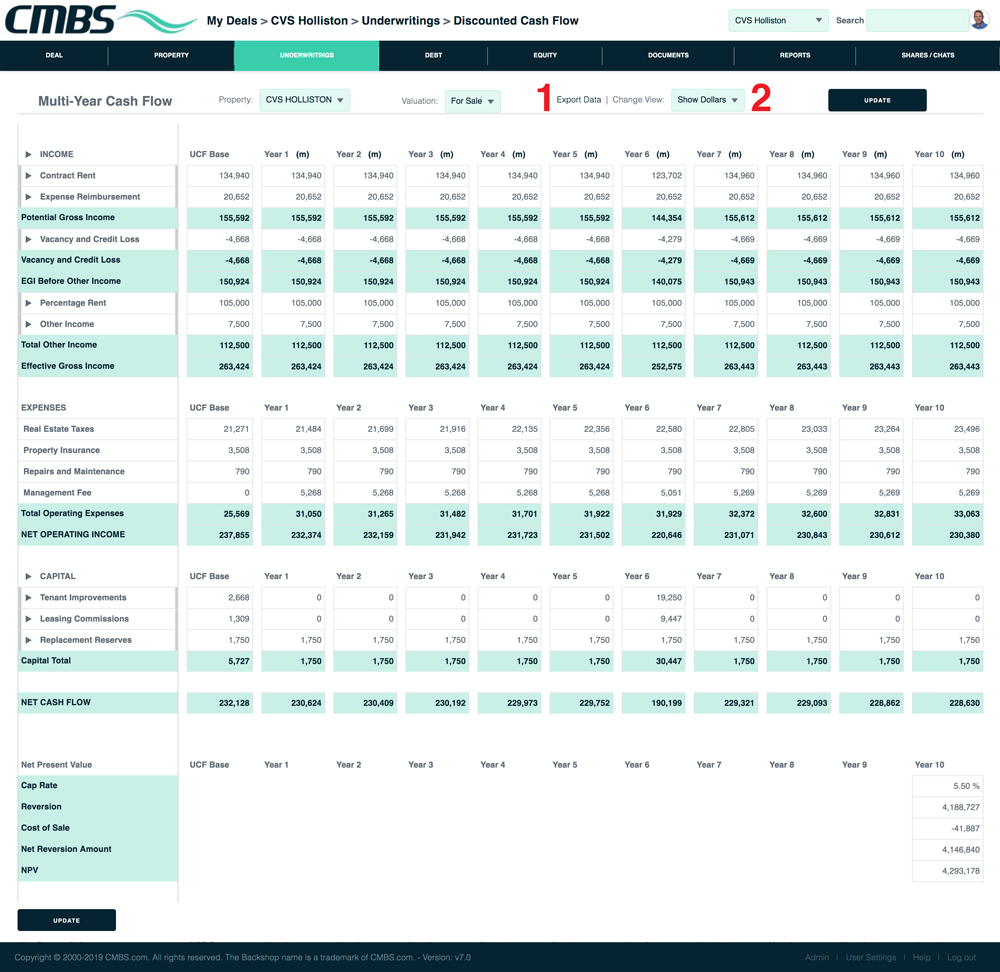

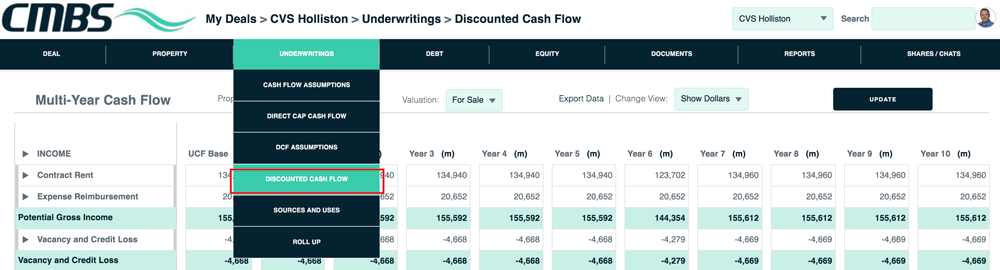

View your multi year cash flow

Go to Underwritings > Discounted Cash Flow.

Here is the “commercial” multi year cash flow.

1. Export the multi year cash flow to Excel.

2. Change view units: all (dollars, percent and per unit) or just dollars.