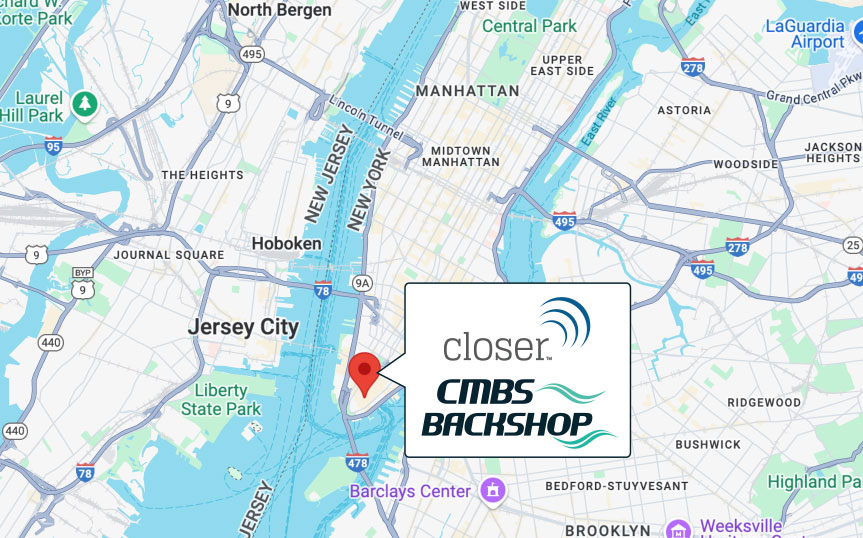

CMBS.com has a new office in Manhattan

At the end of last year, we signed a lease for office space in downtown Manhattan at 40 Exchange Place, which is one block south of Wall Street and kitty corner from the NYSE.

We acquired Closer last fall. Last week I visited the team at 40 Exchange Place, where they had their original office. It’s super exciting to have a physical presence where many of our customers are located. As we continue to merge the Backshop and Closer teams, our clients will get much more in-person attention.

Come see us in suite 401.

Having an office in Manhattan has been a dream of mine since moving from Detroit to Connecticut as a 9th grader. We used to take Metro North and roam Manhattan in high school. I lived on the upper west side in 1995, so I know and love the city, and it feels great to be back.

A giddy start to 2025

In mid January I attended CREFC Miami. The mood was almost giddy. Most everyone thought this year would finally be the start of the recovery we’ve been waiting for. The mantra has been “survive until 2025.” Folks are ready for a good year.

At the end of January, we brought our entire 30-member Backshop/Closer team together in San Francisco to plan the merging of our two companies and apps into one killer team and app. The free flow of ideas was super exciting. More to come on that.

In February I went to the MBA Commercial/Multifamily Finance Convention and Expo in San Diego. While it was more subdued than CREFC, the vibe was positive, and most people believed that 2025 will be solid.

I just returned from the CREFC High Yield, Distressed Asset and Servicing Conference held at the New York Athletic Club. The main takeaway: For those expecting a wave of distress in CRE, that is likely not going to happen. Instead, the prediction is a slow deleveraging process that will play out over the next several years as each asset gets recapitalized (or not) and absorbed by the market. This is based on the big caveat that interest rates and geopolitical events stay sane.

These conferences usually set the tone for the year so, if history holds true, we can expect at least a decent year in CRE finance.

— — —

About CMBS.com

Founded in 2000, CMBS.com provides commercial real estate valuation, pipeline, loan origination, asset management, and securitization management software. The firm’s flagship platform, Backshop, is the leading CRE loan origination, management and servicing platform supporting a range of CRE market participants. CMBS.com is also an authorized third-party data provider to the CMBS industry.

Contact

Jim Flaherty

Founder & CEO, Backshop

jim@cmbs.com

Leave a Reply

Want to join the discussion?Feel free to contribute!